Protect Your Future With Tax-Free IULs

Strategies That Keep You Covered - and Confident.

Learn About Your Personalized Options

with Troy D Roddy, LUTCF

At Roddy Life Planning Group, we help individuals and families build smarter financial futures — with personalized insurance strategies that work. With over 30 years in the financial industry, our team connects you with powerful tools like Indexed Universal Life (IUL), living benefits, and retirement income planning.

Whether you're planning for the future or protecting your family today, we provide professional, unbiased guidance to support your long-term goals. Backed by a nationwide network of experts, we're here to serve you with integrity and care.

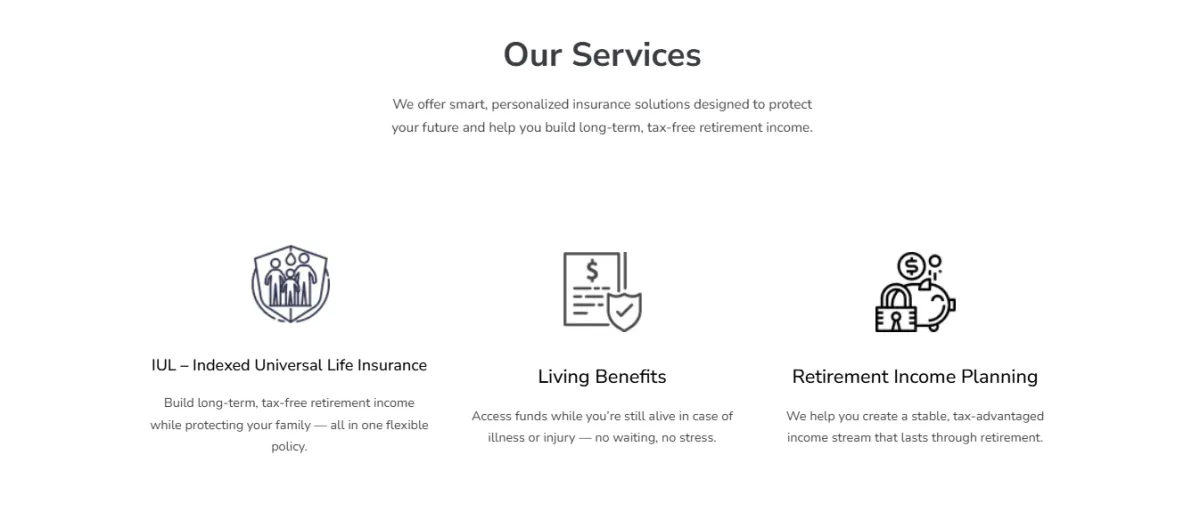

Our Services

IUL – Indexed Universal Life Insurance

Build long-term, tax-free retirement income while protecting your family — all in one flexible policy.

Living Benefits

Access funds while you’re still alive in case of illness or injury — no waiting, no stress.

Retirement Income Planning

We help you create a stable, tax-advantaged income stream that lasts through retirement.

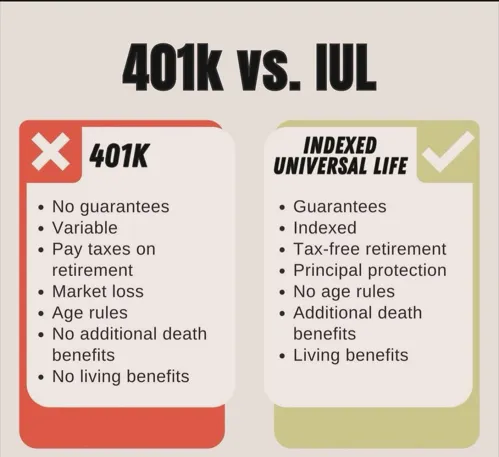

Avoiding common

Retirement Traps

Want a lifetime income stream that you can't outlive without market risk while mitigating taxes?

Learn how you can take control of that old 401K.

Email & Address

Email: [email protected]

Address: Lake Wylie, SC

Get In Touch

Office: (708) 401-RLPG

Cell: (708) 738-3805

What are living benefits, and how do they work?

Living benefits let you access part of your life insurance payout while you’re still alive — if you're diagnosed with a critical, chronic, or terminal illness. This money can be used however you need: medical bills, caregiving, or everyday expenses. There is not a waiting period and it covers up to 18 items.

How much can I receive if I get sick?

It depends on the type of illness and your policy size. For example, you may receive up to:

25% for critical illness (like heart attack or cancer)

50% for chronic illness (like needing daily care)

75% for terminal illness

Some benefits can go up to $1 million, and payments are either one-time or spread annually.

What’s the difference between term, permanent, and Indexed Universal Life (IUL)?

Term insurance covers you for a specific period—typically 10–30 years—and tends to be more affordable.

Permanent insurance (like Whole or Universal Life) lasts your lifetime and builds cash value.

IUL is a type of permanent insurance that offers tax‑deferred cash value growth linked to market indexes—with a guaranteed floor to shield you from negative market returns.

Why Choose Us?

With 30 years of award-winning service, we bring experience, trust, and real results. Our firm provides customized life insurance solutions designed to grow wealth, reduce taxes, and protect what matters most — your family and your future.

We’re not tied to any single product or provider. That means we put your goals first, every time. Supported by attorneys, CPAs, and a network of trusted professionals, we offer nationwide expertise with local care.

Your life is unique — your insurance plan should be too.

Our Experience

All rights reserved. This is not an offer to enter into an agreement. Information and programs are subject to change without notice.

Roddy Life Planning Group, LLC

Troy D Roddy, LUTCF

168 Highway 274 #352, Lake Wylie SC 29710

(708) 892-8681

custom_values.company_logo=https://storage.googleapis.com/msgsndr/waroKpABfujXL6DqfDMd/media/6892599385479ecce0bb8af7.jpeg

custom_values.headshot=https://storage.googleapis.com/msgsndr/waroKpABfujXL6DqfDMd/media/689259accdc026daa450f8e6.jpeg